Overview

Awards and

Achievements

Honored and Felicitated with the ‘Best NPA Management Solution’ award in 3rd BFSI CTO Summit, held in Goa on 11-12th August 2018.

3rd BFSI CTO Summit provides a platform for CXOs across BFSI spectrum to share, ideate and adopt the latest developments and tech innovations to transform the BFS infra. The key theme of this summit was AI, IoT, Blockchain and its impact.

Beacon Suite

Early Warning Signal

Follow up & Collection Solution

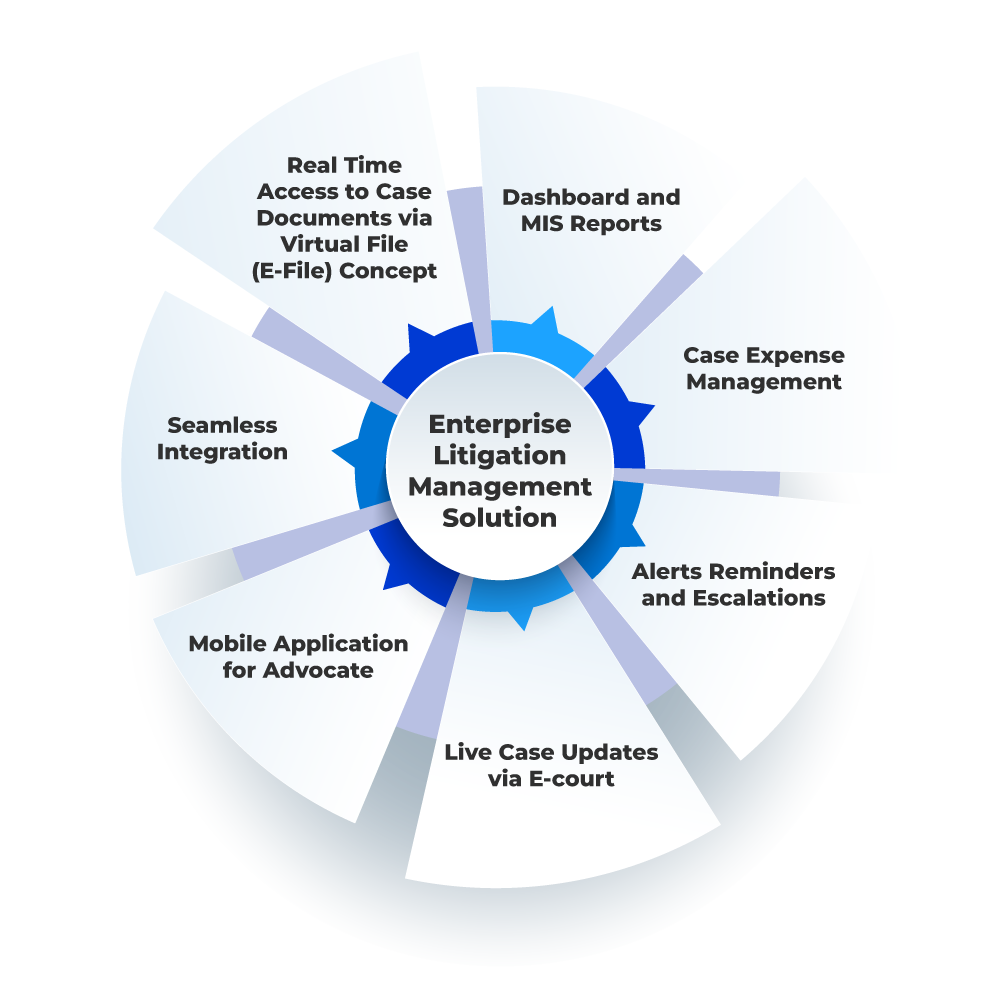

Enterprise Litigation Management Solution

Mobile Application

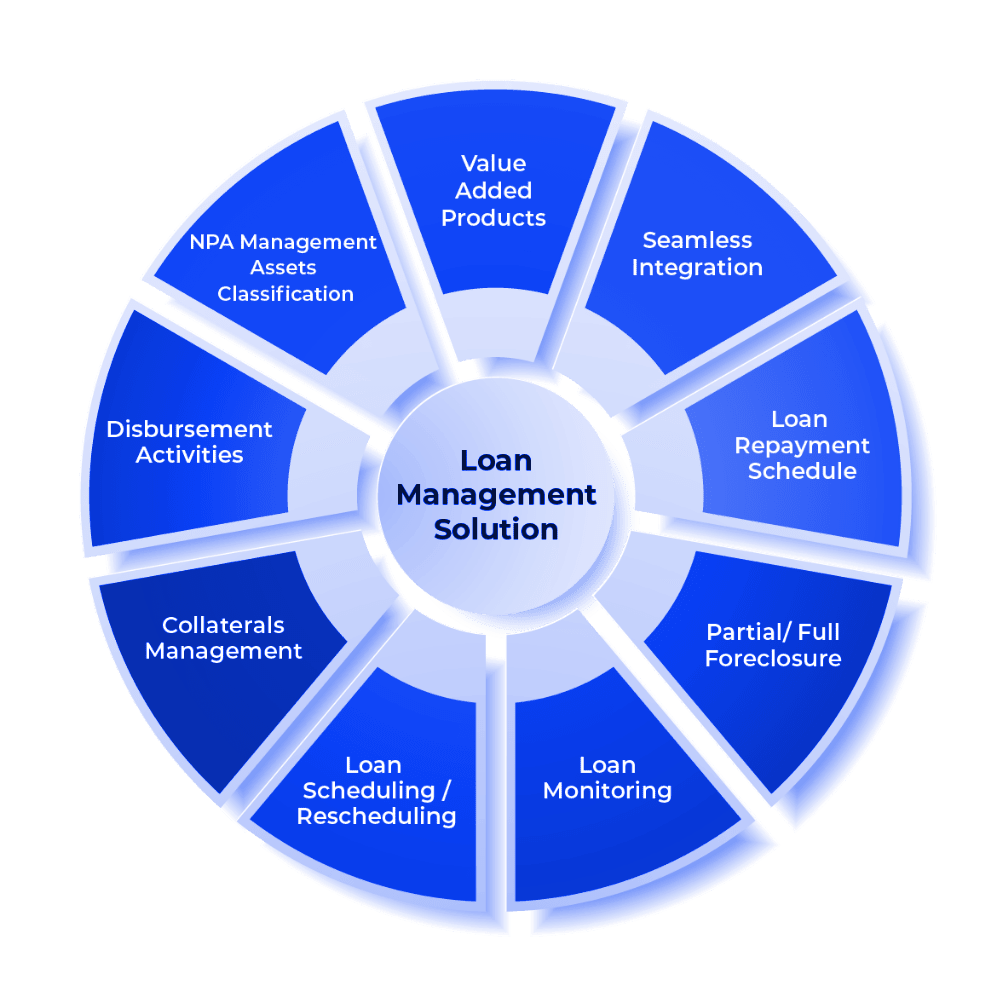

Loan Management Solution

Loan Origination System

Financial Inclusion Solution

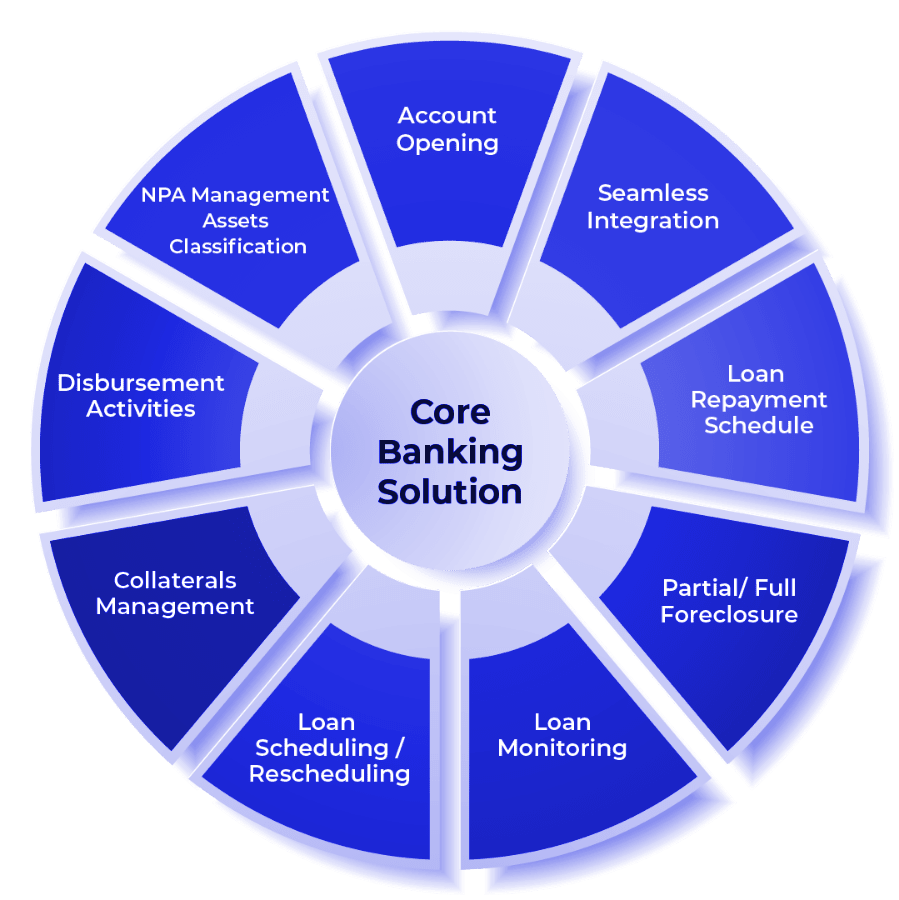

Core Banking Solution

Early Warning Signal

EWS is a comprehensive analytical solution offering Default Prediction Models that use Machine Learning (ML) and AI (Artificial Intelligence) to support Early Resolution and Loss Mitigation.

Follow up & Collection

Enterprise Litigation Management Solution

Mobile Application

Loan Management Solution

Loan Origination

System

Financial Inclusion Solution

Core Banking Solution

A cutting-edge, browser-based, banking application. Comprehensive and easy to use, it creates a feature rich platform for introducing new products, services, and controls.

Client Testimonials

Clientele

Benifits of Partnering with speridian

Deep operational and integration experience across financial services.

Modernize operational processes and applications for increased agility.

Cash in on reduced infrastructure and operational costs.

Best of breed solutions built specifically for financial institutions.

Strengthen regulatory compliance efforts and improve application security.