Don’t Wait, the Time for Digital Transformation in Financial Institutions is Now

Is your company missing out on the massive digital transformations currently reshaping businesses across the globe? If so, you’re probably in a highly-regulated sector like energy, financial services, healthcare, or pharma. Watching from the shore as other industries ride the wave of digital transformation might feel like a safe bet, but adopting new technology too late poses a serious risk to your company’s long term success. This is more true of financial institutions than it is for any other sector.

Table of Contents

Misconceptions Around Digital Transformation in Banking

One of the biggest mistakes financial institutions make is assuming that digital transformation in financial services is only about the technology. So, well-intentioned companies that put their mission first typically end up pushing innovation to the backseat. This is a shortsighted strategy that fails to recognize how innovation in banking is actually about people (both customers and employees), and has the potential to revolutionize how you do business.

Benefits Digital Intelligence offers Financial Institutions

Most of the current concerns facing the industry can be addressed through the innovations digital transformation offers.

Managing Regulatory Requirements and Compliance

When the effort going into regulatory compliance becomes so great that keeping up undermines core organizational goals—your company has a problem. Not to mention the increasing cost of compliance, expected to reach a staggering 10% of firm revenues in 2022. Artificial intelligence in banking can reduce the costs of highly-manual compliance processes, while increasing productivity, performance, and security.

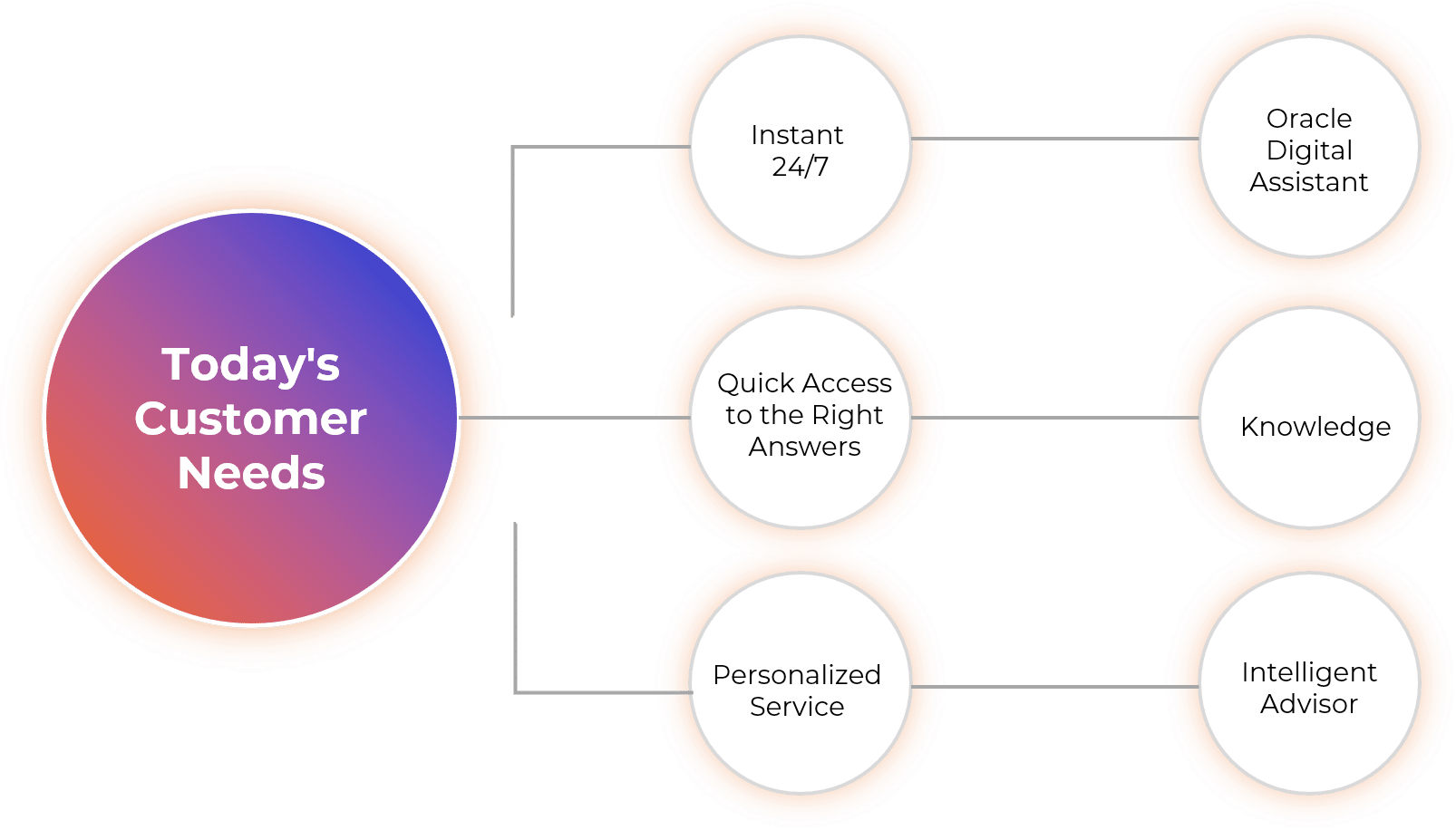

Meeting Increased Customer Expectations

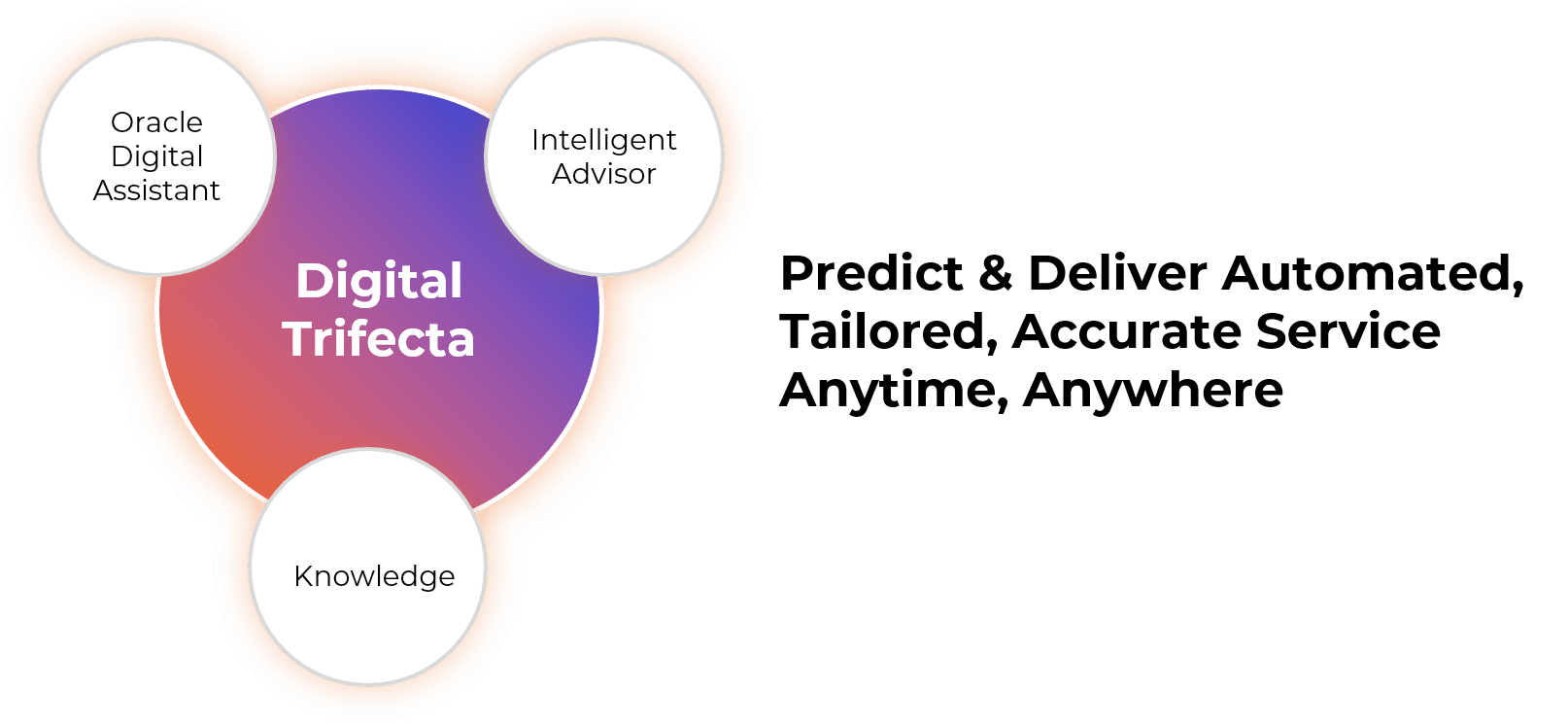

Growing competition in an increasingly tech-driven industry means that companies providing financial services must adapt to digital transformation if they want to keep up. Customers expect instant, personalized service 24/7 and quick access to the right answers to their questions. The answer is a fully-integrated Digital Trifecta, a solution that we already offer. We can provide a chatbot that instantly answers FAQs and helps customers resolve common banking issues. In addition to being able to provide information about COVID, PPP, and Stimulus questions, the chatbot can also connect customers to a digital appointment setting portal or direct interested customers to products and sales teams.

Download 2021 Digital Transformation Guide for Financial & Banking Institutions

Decoding the Digital Trifecta solution from Oracle

The answer is a fully-integrated Digital Trifecta, a solution that we already offer. We can provide a chat bot that instantly answers FAQs and helps customers resolve common banking issues. In addition to being able to provide information about COVID, PPP, and Stimulus questions, the chat bot can also connect customers to a digital appointment setting portal or direct interested customers to products and sales teams.

Digital Process Automation

The automation of end-to-end processes offers financial institutions far more than just increased efficiency. Automating digital processes both increases accuracy and reduces operating costs. Digital transformation platforms are also helping companies achieve progress without having to compromise security. In fact, digital transformations are creating a more secure foundation for safe and stable automated operations— one that offers greater control and risk management in complex financial ecosystems. Automated processing enables rapid-detection of unusual activity and can mitigate harmful actions in real-time. Technologies such as AI, machine learning, and RPA can create highly-scalable operational efficiencies that keep the fiscal wheels turning smoothly on a day-to-day basis.

Moving into the Future of Financial Service

While there still may be major barriers, Speridian Technologies can show you how digital transformation in financial services is possible.

“It’s a lot of fun to imagine the impossible” – Walt DisneyWhat might have seemed far-fetched only a few years ago is now a reality. Where we go from here is anyone’s guess, but the current possibilities are already revolutionizing the way our clients do business:

Imagine that when an employee makes a decision or completes a task, their processes are automatically documented in the platform, creating a digital paper trail with all the metadata needed to stand up to rigorous scrutiny. When auditors come in, your organization no longerhas to gather together all kinds of paperwork; they can simply give the auditors access to their platform and let them get to work. This is only one example of what is possible with digital transformation.

The traditional business models in finance and banking have been radically improved through digital transformation. To learn more about how to make your business more effective, create better customer and employee engagement, and increase your company’s capacity, contact a Speridian associate today.