Proactive Risk Management with Beacon Early Warning Signals

PRODUCT OVERVIEW

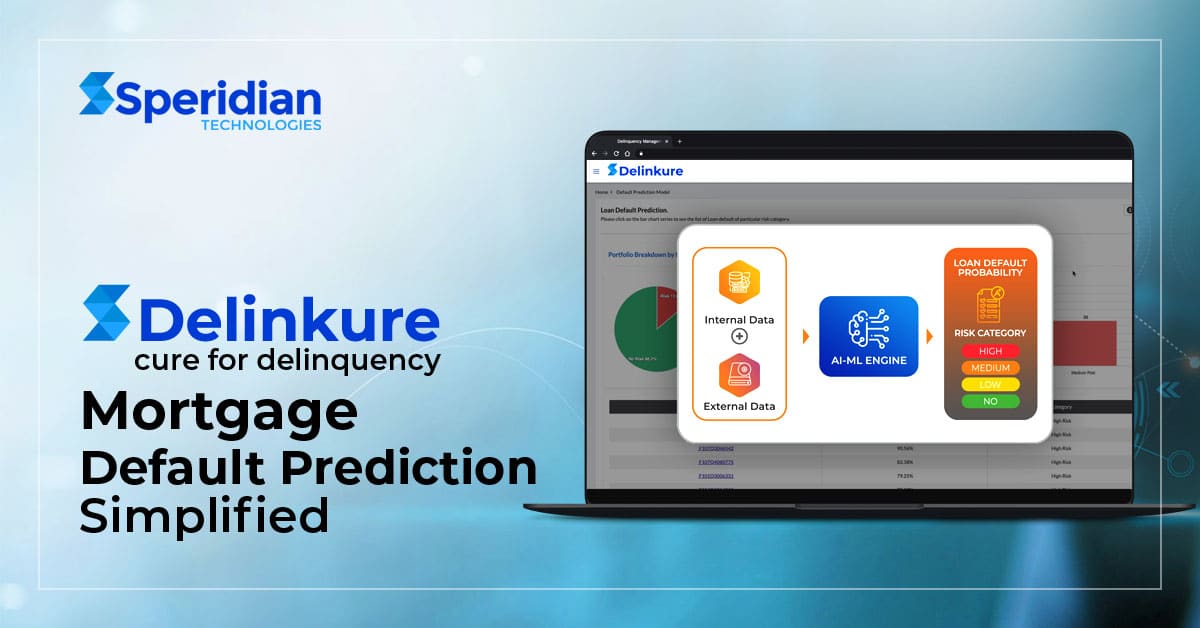

The current economic situation has experts predicting a significant rise in mortgage default rates leading to massive losses. To stay ahead, financial institutions will need an effective credit risk and monitoring tool to empower their teams. Introducing Early Warning Signal, a comprehensive analytical solution offering Default Prediction Models that use Machine Learning (ML) to support Early Resolution and Loss Mitigation.

KEY FEATURES

Upload and validate a loan portfolio file – excel, CSV, or flat files

Process the loan portfolio file to determine the probability of default and assign risk categories to each loan account

Individually analyze loan instances and their probability of default

Get a summary of risk categorization on the portfolio and the ability to drill down on each loan assigned with a risk score

Download the prediction report in PDF or Excel format

Run Early Resolution workflows on each loan (add-on)

Integrate with other applications through API (add-on)

EARLY WARNING

SIGNAL BENEFITS

A clear view of portfolio risks of your active mortgage accounts

Find risky loans before they have a default event and mitigate your potential losses

Prioritize the portfolio to take early resolution steps based on the risk scores

Integrate with risk analysis and early resolution workflow